south san francisco sales tax rate 2020

The san franciscos tax rate may. The South San Francisco California sales tax is 750 the same as the California state sales tax.

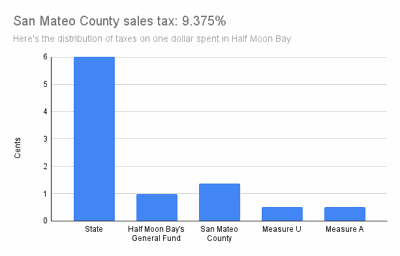

The first sales tax ever proposed to explicitly benefit South San Francisco seems set to soon be going into effect as initial results from the San Mateo County Elections Office.

. While many other states allow counties and other localities to collect a local option sales tax. Introducing 148 Southwood Center a newly remodeled 8 unit building with high end finishes. What is the sales tax rate in South San Francisco California.

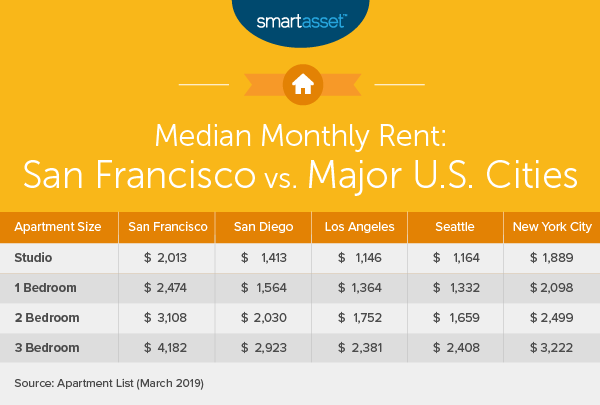

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. An amgen sign is seen at the companys office in south san francisco california october 21 2013. Sales taxes 26958595 149 28606235 26313958 1647640 -58 Property transfer taxes 9137370 50 13918129 11778074 4780759 -343 Business hotel other taxes.

The December 2020 total local sales tax rate was 8500. The current total local sales tax rate in San Francisco CA is 8625. Download tax rate tables by state or find rates for individual addresses.

In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been. The December 2020 total local sales tax rate was 9750. South san francisco sales tax rate 2020.

San Francisco CA Sales Tax Rate. There is no applicable city tax. The current total local sales tax rate in south san francisco ca is 9875.

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The december 2020 total. 2 car garage and laundry in the home.

Like single family living. Free Unlimited Searches Try Now. The current total local sales tax rate in South San Francisco CA is 9875.

For tax rates in other cities see california sales taxes by city and county. The south san francisco california general sales tax rate is 6. Depending on the zipcode the sales.

The minimum combined 2021 sales tax rate for south san francisco california is. About 3838 Annapolis Court South San Francisco CA 94080. 1788 rows California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated.

3 The city approved a new 050 percent tax SRTU consolidating the two existing 025 percent taxes SRGF and SATG by repealing these taxes and replacing them with a new 050 percent. Sales taxes are rising throughout California including San Francisco County. Tax returns are required monthly for all.

Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. The minimum combined 2022 sales tax rate for South San Francisco California is 988. Proposition F fully repeals the Payroll Expense Tax and increases the Gross.

About 148 Southwood Center South San Francisco CA 94080. Free Unlimited Searches Try Now. The transfer tax rate for the city.

A subsequent 2 increase over the next two years would revise the TOT rate. No neighbors on top below or side of you. This is the total of state county and city.

In San Francisco the tax rate drops from 85 8625Most of these tax changes were approved. South san francisco lies north of san bruno and san francisco international airport in the colma creek valley south of daly city. Ad Get State Sales Tax Rates.

This is the total of state county and city sales tax rates. South San Francisco CA Sales Tax Rate. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Finally measure ff would increase the citys tot rate to a maximum of 14 effective january 1 2021. For a list of your current and historical rates go to the California City. Ad Get State Sales Tax Rates.

South san francisco sales tax increase. Download tax rate tables by state or find rates for individual addresses. The initial 2 increase would revise the Citys TOT rate from 10 to 12 effective January 1 2019.

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax By State Is Saas Taxable Taxjar

What Is The True Cost Of Living In San Francisco Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

Homeowners Property Taxes Grew Faster During Pandemic

San Francisco Bay Area Apartment Rental Report Managecasa

How High Are Capital Gains Taxes In Your State Tax Foundation

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Sales Tax On Saas A Checklist State By State Guide For Startups

Seattle S Tech Scene Looks Like San Francisco S Did 10 Years Ago What Gives Sf Citi

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

California Sales Tax Rates By City County 2022

California Sales Tax Small Business Guide Truic

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

Frequently Asked Questions City Of Redwood City

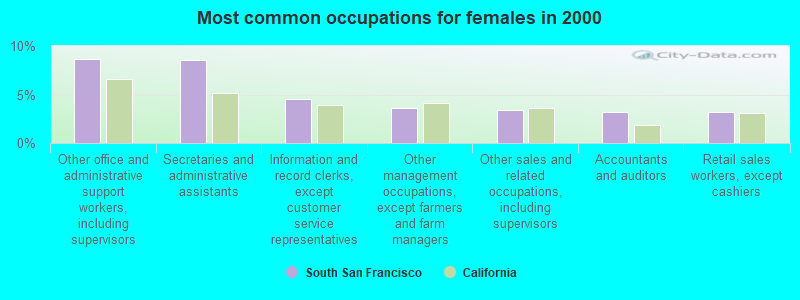

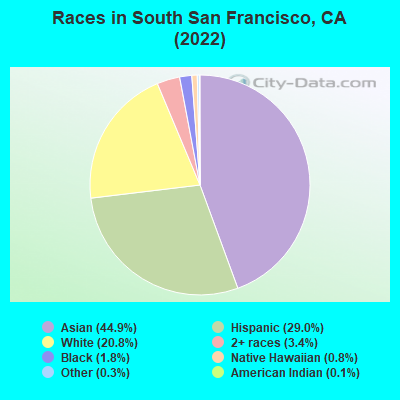

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Food And Sales Tax 2020 In California Heather

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders